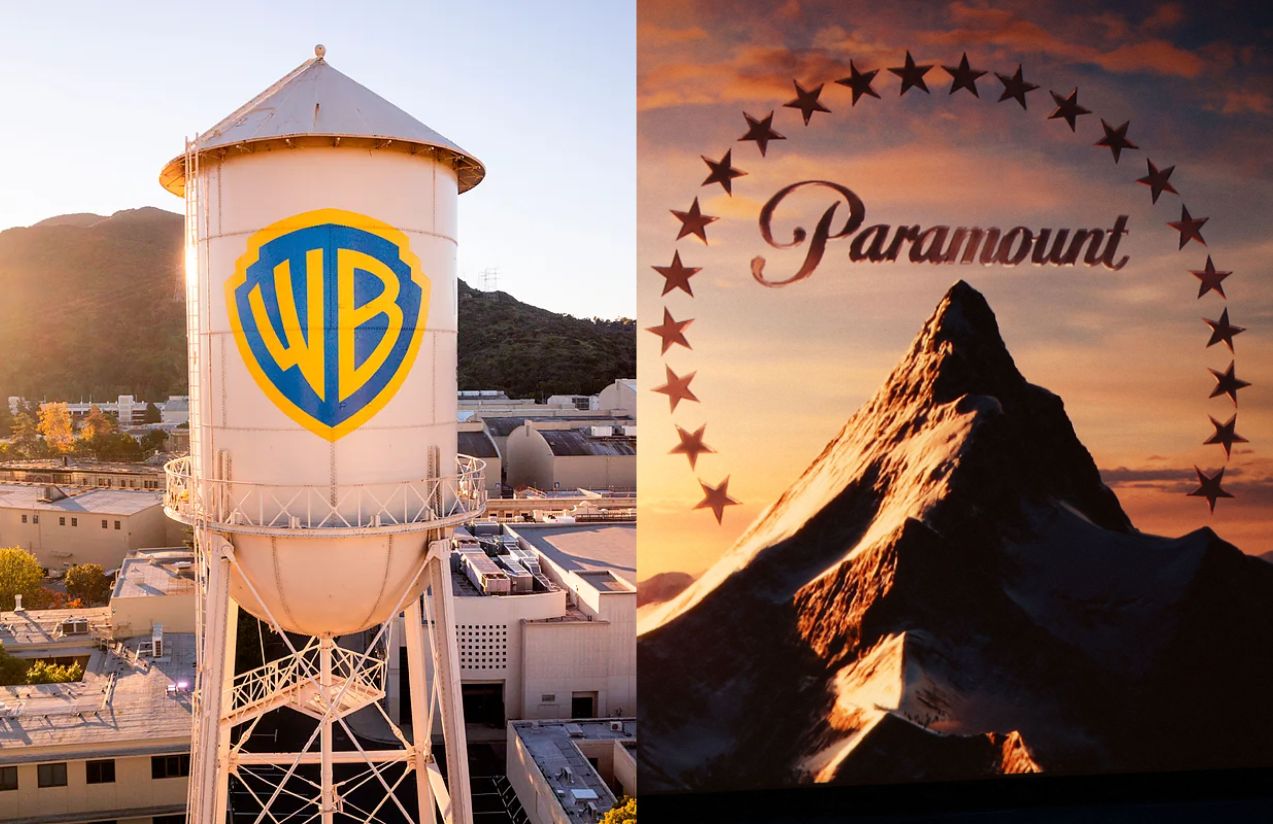

The board of directors of Warner Bros. Discovery has unanimously rejected the improved $108.4 billion offer submitted by Paramount Skydance, describing it as risky and less beneficial for the company and its shareholders.

Although Paramount attempted to enhance its proposal with a $40.4 billion personal guarantee from billionaire Larry Ellison, Warner determined that the heavy reliance on debt financing could jeopardize the completion of the deal.

Read More

In contrast, Warner reaffirmed its preference for a merger agreement with Netflix, valued at nearly $83 billion, which includes the acquisition of its studios, HBO Max, and other key divisions. According to the company, this strategy offers greater certainty and long-term value for shareholders, without the risks associated with Paramount’s offer.

This decision keeps consolidation in the entertainment industry alive and could reshape Hollywood’s hierarchy, with Netflix further strengthening its dominant position in production and distribution.

Why does Warner prefer the company with the big red “N” over Paramount?

Because Netflix’s offer is considered more stable and beneficial for shareholders, with greater certainty of completion and lower financial risk in the short, medium, and long term.